Steel production in the countries of the Middle East and North Africa remains below the level of demand for steel in the region, making it one of the major export markets for the world’s steelmakers. ISSB maintains a fully detailed database of the exports and imports of steel and steelmaking raw materials for more than 60 major steelmaking nations, collectively accounting for 97% of global steel output. With the national trade data of the countries within the MENA region not readily available ISSB’s coverage of the world’s dominant exporters places us in a leading position to assess the markets of the Middle East and North Africa. Below we summarise some of the latest data available regarding the region.

Crude Steel Production

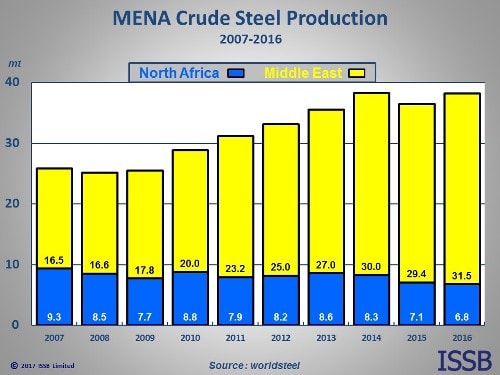

Although the MENA region did see a small decline in crude steel production during the 2008 and 2009 downturn, since then output has been climbing steadily with 2014 producing a figure which is an impressive 42% above that of 2007. It can be seen, however, that this increase is driven by an increase in Middle East production at the expense of production in North Africa with the 2014 figure for the Middle East 73% above that in 2007 compared to a 12% fall in North Africa. The growth is being driven by Iran, the dominant regional player, although UAE, Qatar and Saudi Arabia are all substantially above the levels seen in 2007.

Trade in Steel

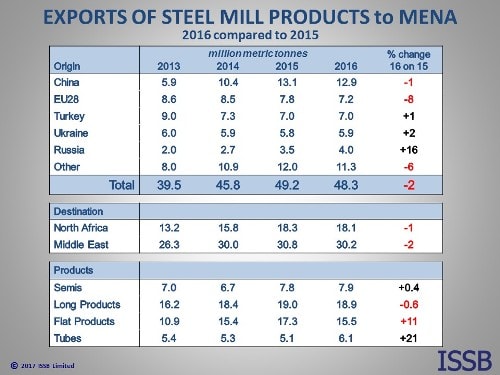

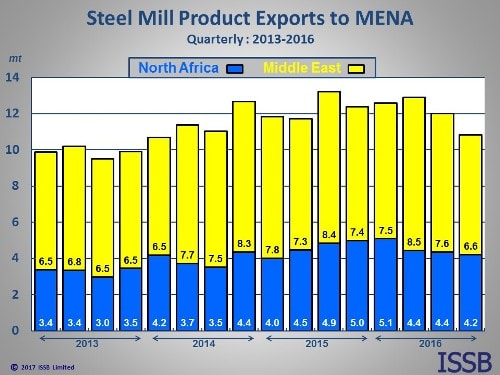

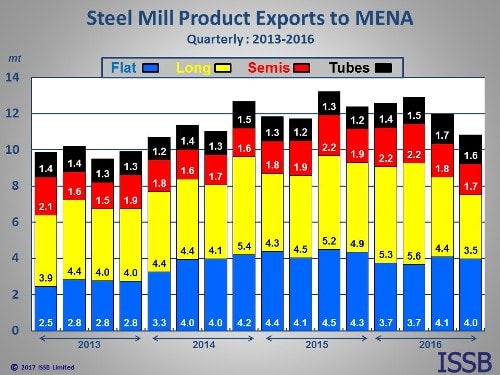

Combined exports of Steel Mill Products (semis, long & flat products, tubes) to the MENA region as a whole reached a peak of 50 million tonnes in 2008 before declining to just under 40 million tonnes by 2013. Last year saw a 10% recovery, however, as exports in 2014 reached 43.6 million tonnes.

Exports to North Africa have shown a steady increase over the past few years with 2014 seeing an 18% growth year on year. In contrast, exports to the Middle East have seen a much more volatile trend, although exports to the region did increase by 6% in 2014.